Editor’s Note: Stephen G. Cecchetti is Rosen Family Chair in International Finance at the Brandeis International Business School and vice chair of the Advisory Scientific Committee of the European System Board. Kermit L. Schoenholtz is Clinical Professor Emeritus at New York University’s Leonard N. Stern School of Business. He is a member of the Council on Foreign Relations. Cecchetti and Schoenholtz author a popular economics blog at www.moneyandbanking.com. The opinions expressed in this commentary are their own.

In June, US inflation hit a 40-year high of 9% and hasn’t slowed much since. Some people argue that corporate greed is a key driving force behind rising prices. Inflation is high, they say, because firms have greater power to raise prices and increase profits than they did in previous decades.

We disagree.

Instead, over the past few quarters, the rise increasingly reflects the tight labor market and the increase in labor costs, including wages and benefits.

Businesses set the prices of their products so that they can earn a profit beyond the costs of their labor and materials. Their profit margins and markups typically rise and fall with demand. If sales permit, a rise in costs or profit objectives will lead firms to raise the prices of their products. When this occurs persistently across the economy, not just in an isolated firm or sector, the result is inflation.

Some people argue that, over recent decades in broadening swaths of the US economy, a few dominant firms can more easily raise their profit margins, resulting in corporate “greedflation.” To be sure, there is substantial evidence both for increased concentration and reduced competition. In addition, from the early 1960s to the end of 2019, the share of business income used to compensate workers declined by nearly 10 percentage points to 57%, allowing businesses to pocket more in profits. Importantly, however, this long-run shift away from workers’ incomes and toward firm profits came regardless of whether inflation was high or low.

Moreover, we see little evidence that greedflation is driving the recent rise in inflation. In the decades prior to the pandemic, both labor costs and profits contributed significantly to inflation. But the 2020s are strikingly different. Over the past two-and-a-half years, labor costs look to be the real culprit, not profits. Indeed, labor’s share of business income has climbed back toward 60% since the pandemic, reversing a modest portion of the long-run decline.

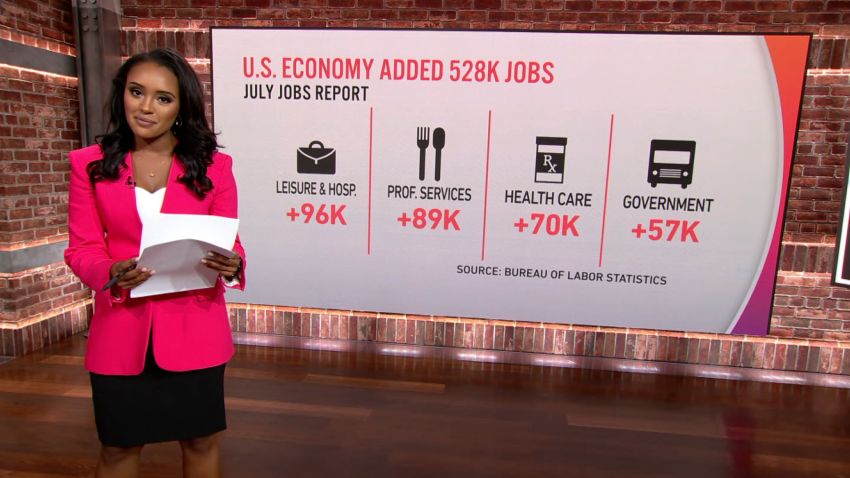

Why do labor costs account for such a large fraction of the recent rise in inflation? There are two key reasons. First, the US labor market is extremely tight. The combination of a 3.5% unemployment rate and a 6.6% vacancy rate — nearly two openings for each person searching for a job — is unprecedented. As a result, wages and salaries are rising at an annual rate of 5.7%, more than two percentage points faster than before the pandemic. Second, even as output slipped, firms continued to hire new workers rapidly this year, so productivity (the ratio of output per hour worked) tumbled. As a result, labor costs per unit of output are up by more than 9% over the past year — another 40-year record. Because labor compensation is the largest component of firms’ costs, surging unit labor costs tend to squeeze profits, incentivizing companies to raise prices.

Over the 40 years prior to the pandemic, labor productivity (measured as output per hour) grew on average by 1.8% per year. This means that average wage increases of only 3.3% were easily consistent with the Federal Reserve’s 2% inflation target. However, recent annual wage gains are roughly three percentage points faster. Unless tightness in the labor market eases significantly, labor cost inflation is unlikely to come down, and could even rise further.

The only way to bring inflation down to 2% is to slow the economy and cool the labor market. To do this, the Federal Reserve will need to tighten its monetary policy considerably further by continuing to raise rates.

As for “greedflation,” firms are always greedy, so this is not why inflation is so high today. Consequently, attacking corporations for trying to increase their profits will not reduce inflation. That will require slowing demand for their products and, in turn, their need for more workers.