Robinhood’s highly-anticipated debut on Wall Street is getting off to a rough start.

The fast-growing trading company failed to raise as much money as it had hoped. Robinhood’s initial public offering priced at $38 a share, the low end of the expected range. That suggests demand for the controversial company may have been softer than anticipated.

The deal values Robinhood at about $32 billion, making it more valuable than major companies including Nasdaq (NDAQ), Southwest Airlines (LUV) and Kroger (KR). That’s well above the $12 billion price tag Robinhood scored in its most recent round of private funding.

And yet Robinhood failed to hit the $35 billion valuation it had coveted.

The IPO is raising $2.1 billion and Robinhood is expected to begin trading on the Nasdaq on Thursday under the ticker symbol “HOOD.”

The deal is still a major milestone for a company that revolutionized the way Americans invest and is enjoying explosive growth.

“The business has been a juggernaut. They’ve got a great platform they can build off of,” said David Weild, former vice chairman of the Nasdaq who is now the CEO of investment bank Weild & Co.

Robinhood’s revenue surged by 245% last year to $959 million as its user growth and trading volume exploded.

Robert Le, analyst at PitchBook, said Robinhood appears to be leaving some money on the table in an effort to get a first-day pop in its share price.

“Robinhood is playing it safe here,” Le said in an email. “There is more hanging in the balance in terms of a successful novel IPO than a couple hundred million dollars in the bank for the company.”

‘It seems rich’

But investors are paying a premium for that growth.

At the high end of Robinhood’s IPO range, the deal would have valued the company at about 22 times trailing revenue, according to Renaissance Capital. That compares a multiple of just five for Charles Schwab (SCHW), a rival that is expanding at a slower pace.

“It seems rich — unless the company can keep up this high growth,” said Kathleen Smith, a principal at Renaissance Capital, which manages the Renaissance IPO ETF (IPO).

Robinhood completely disrupted the online brokerage industry by pioneering zero-commission trading. As Robinhood lured new and existing investors to its platform, rivals were forced to eliminate trading fees and join forces just to survive.

Now Robinhood is disrupting the IPO process. The company is allowing its users to buy a chunk — as much as one-third — of the IPO shares before they begin trading on the Nasdaq. Normally, only corporate insiders and powerful institutions get access to these coveted shares.

New regulatory probes revealed

Robinhood’s public debut was delayed by a series of controversies, from record-breaking settlements to massive outages, that raise questions about the company’s business model, management team and ability to keep up with its explosive growth.

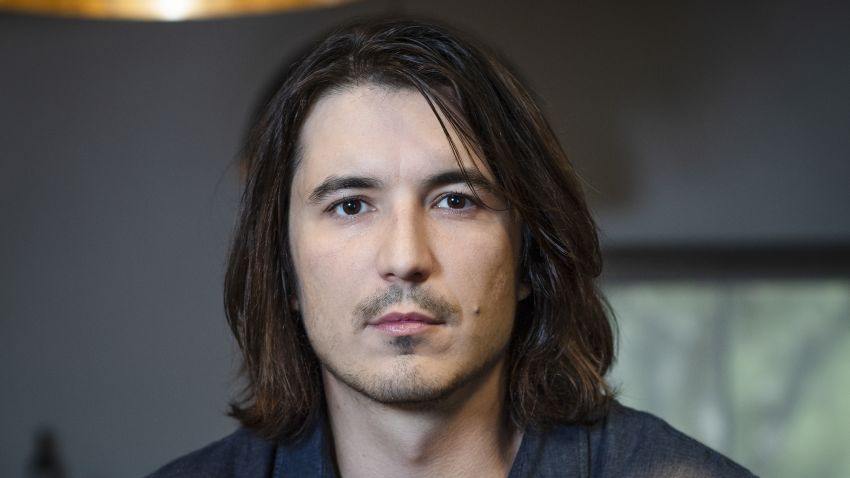

Just this week, Robinhood disclosed that regulators are investigating the fact that CEO Vlad Tenev is not licensed with FINRA, Wall Street’s powerful self-regulator. (Robinhood has argued Tenev does not need to be licensed because he’s the CEO of the parent company, not the broker-dealer).

The Financial Industry Regulatory Authority and the Securities and Exchange Commission are also probing whether Robinhood employees traded shares of GameStop (GME), AMC (AMC) and other “meme” stocks ahead of the trading platform’s infamous trading restrictions in January.

Last month, FINRA slapped the brokerage with its biggest-ever penalty and accused the company of harming millions of customers and giving investors “false or misleading information.” FINRA cited in part options trading procedures at the heart of a recently settled lawsuit filed by the family of a 20-year-old Robinhood trader who died by suicide last year.

Robinhood neither admitted to nor denied the FINRA charges.

Weild, the former Nasdaq executive, said Robinhood’s struggles may have only enhanced public awareness about the company — something that ironically helps. He likened the situation to challenges that faced America Online during its rapid expansion.

“All it did was increase their visibility and branding,” Weild said.

Other companies with legal headaches were similarly able to pull off IPOs, including Airbnb and Uber (UBER).

‘These are not free apps’

But Robinhood’s struggles have also shined a bright light on the company’s controversial business model, known as payment for order flow. Like some other online brokerages, Robinhood makes most of its revenue by selling its retail order flow to high-speed trading firms like Citadel Securities.

Robinhood argues that this tactic benefits everyday investors because it has paved the way for no-commission trading. But others say it’s really the high-speed trading firms that are benefiting — otherwise they wouldn’t be paying Robinhood for the order flow.

Now that business model that Robinhood is so reliant on is in doubt. The Securities and Exchange Commission is reviewing payment for order flow. SEC Chairman Gary Gensler warned in May that there are “inherent” conflicts of interest in this business model and expressed concern about the gamefied nature of trading apps.

“These are not free apps. They are just zero-commission apps. The cost is inside the order execution,” Gensler told lawmakers.

If the SEC bans payment for order flow, it would deal a blow to Robinhood.

“We think payment for order flow is a benefit to retail investors,” said PitchBook’s Le. “But if regulators don’t see it that way and ban it, Robinhood will have to find new sources of revenue. That would be a big risk.”

Levered to the market boom

Robinhood faces competition from not only well-established online brokerages, but from upstarts like Public.com and Invstr that market the fact that they do not sell retail order flow to high-speed traders.

Smith, the Renaissance Capital executive, said another risk is how closely linked Robinhood’s bottom line is to the fate of booming markets.

“What if we get a negative market? People could easily get turned off if they lose money,” Smith said. “This company is so levered to equity and crypto markets. A downturn would hurt Robinhood more than a Charles Schwab.”